Preface

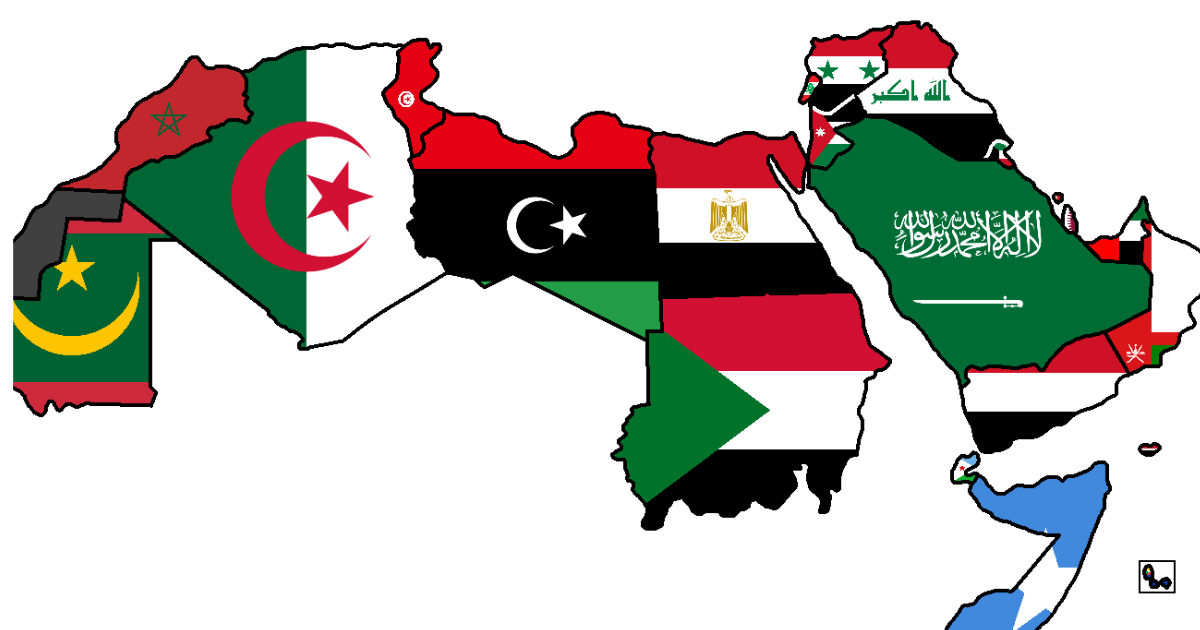

The Arab world is famed for its rich history, different societies, and profitable prowess. Among the nations that make up the Arab region, several have stood out as profitable bootstrappers, boasting emotional wealth and fiscal stability. In this blog post, we will claw into the realms of the richest Arab countries, exploring the factors that contribute to their substance and the impact of their wealth on both indigenous and global scales.

Qatar: The Jewel of the Gulf

At the van of the flush Arab nations is Qatar, a small promontory in the Arabian Gulf with outsized profitable influence. Fueled by its vast natural gas reserves, Qatar has witnessed a profitable smash over the once many decades. The country’s wise investment in structure, education, and tourism has played a vital part in its profitable success. The futuristic skyline of Doha, the capital, is a testament to the rapid-fire development and modernization that has taken place.

Qatar’s autonomous wealth fund, the Qatar Investment Authority (QIA), is one of the largest in the world, investing in a different range of sectors encyclopedically. The successful shot to host the 2022 FIFA World Cup has further propelled Qatar into the transnational limelight, showcasing its profitable muscle and ambition.

United Arab Emirates: The Oasis of Prosperity

Comprising seven emirates, including Dubai and Abu Dhabi, the United Arab Emirates (UAE) has surfaced as a global profitable mecca. Fueled by oil painting earnings, the UAE has diversified its frugality, fastening on sectors similar as tourism, real estate, and finance. Dubai, in particular, has come synonymous with luxury and substance, boasting iconic milestones like the Burj Khalifa and hosting extravagant events like the Dubai Shopping Festival.

The visionary leadership in the UAE has been necessary in steering the nation towards profitable success. Forward-allowing programs, strategic investments, and a business-friendly terrain have attracted transnational businesses and investors, contributing to the country’s profitable substance.

Kuwait: Petrodollars and Prudent Investments

Kuwait, positioned at the northern tip of the Arabian Gulf, has long been a crucial player in the global oil painting request. Its substantial oil painting reserves have handed the country with significant earnings, allowing for robust government spending and investments. Kuwait’s autonomous wealth fund, the Kuwait Investment Authority (KIA), is among the oldest and largest in the world.

Despite its reliance on oil painting, Kuwait has honored the significance of diversification and has accepted enterprise to develop other sectors, including finance, real estate, and healthcare. Prudent investment strategies and a commitment to profitable stability have helped Kuwait rainfall oscillations in oil painting prices and maintain its status as one of the richest Arab nations.

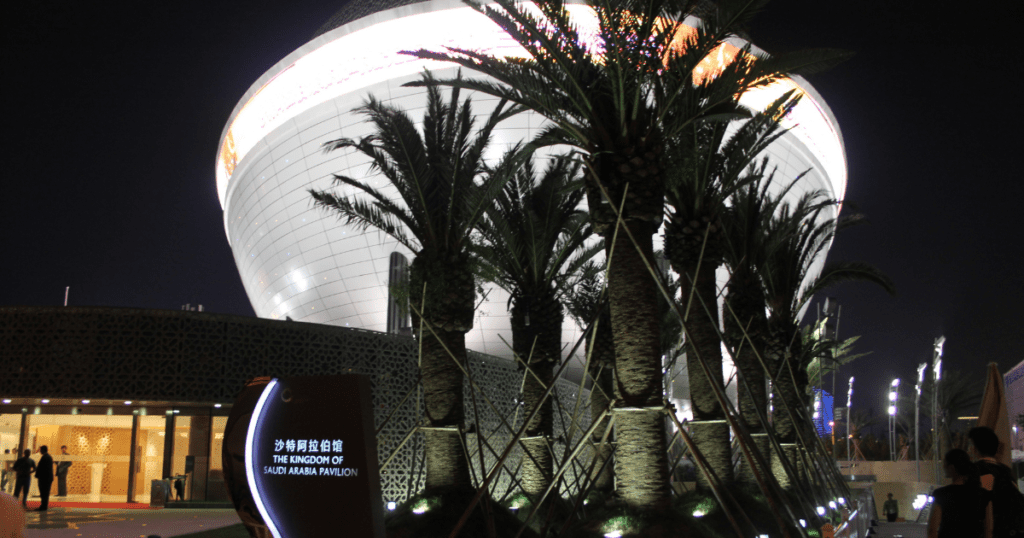

Saudi Arabia: Vision 2030 and Beyond

As the largest country in the Arab world, Saudi Arabia holds a central position in the region’s profitable geography. Traditionally dependent on oil painting earnings, the Kingdom has embarked on an ambitious metamorphosis trip with its Vision 2030 action. Commanded by Crown Prince Mohammed bin Salman, Vision 2030 aims to diversify the Saudi frugality, reduce dependence on oil painting, and boost sectors like tourism, entertainment, and technology.

The Saudi Arabian Public Investment Fund (PIF) has come a crucial player in global investments, bearing gambles similar as the development of the futuristic megacity of NEOM. While Vision 2030 faces challenges, including geopolitical pressures and global profitable misgivings, its perpetration marks a significant step toward a more diversified and sustainable frugality.

Bahrain: The Financial Mecca of the Gulf

Nestled between Qatar and Saudi Arabia, Bahrain has deposited itself as a indigenous fiscal center. While oil painting plays a part in its frugality, Bahrain has been visionary in diversifying, fastening on sectors like finance, tourism, and real estate. The Bahrain Financial Harbour, a prominent business and domestic complex, symbolizes the country’s commitment to getting a leading fiscal mecca in the Gulf.

Bahrain’s strategic position, coupled with a business-friendly terrain, has attracted transnational pots and fiscal institutions. The government’s sweats to produce a conducive ecosystem for business have contributed to Bahrain’s profitable adaptability and substance.

Conclusion

The richest Arab countries showcase a blend of strategic vision, prudent profitable programs, and the exploitation of natural coffers. While oil painting has historically been a primary motorist of wealth in the region, these nations are decreasingly feting the significance of diversification to insure long-term profitable sustainability. As they continue to invest in structure, education, and invention, the ripple goods of their substance are felt not only within the Arab world but across the global profitable geography.